파트1 기본이론정리 13

각 분야별로 정리 요약하여 이론시험 대비

제1장 | 재무회계 정리 ········································································· 15

제1절 | 회계의 기초 ································································ 15

제2절 | 당좌자산 ····································································· 34

제3절 | 재고자산 ····································································· 49

제4절 | 유형자산 ····································································· 59

제5절 | 무형자산 ····································································· 66

제6절 | 투자자산과 기타비유동자산 ······································· 70

제7절 | 부 채 ········································································· 78

제8절 | 자 본 ········································································· 88

제9절 | 수익과 비용 ································································ 99

제10절 | 비영리회계 ······························································ 121

제2장 | 원가회계 정리 ·························

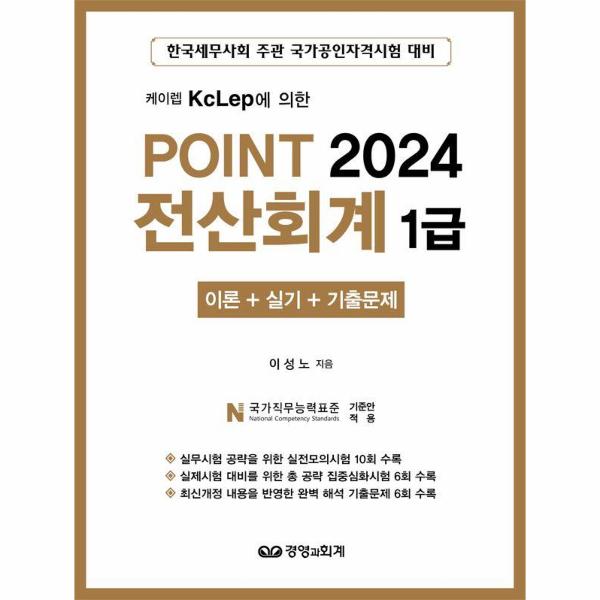

기업의 회계처리와 세무업무가 전산화되면서 회계 담당자들은 이론적으로 회계와 세무업무를 익히는 것만이 아니라 전산업무도 숙지하는 것이 필수가 된지 오래되었다. 모든 분야의 전산화가 회계분야에도 지대한 변화를 가져오고 그 변화에 따라 한국세무사회의 국가공인 전산세무회계 자격시험이 도입되었다.

전산세무회계 검정시험은 회계와 세무에 대한 이론만으로 되는 것도 아니고 컴퓨터를 아는 것만으로도 될 수 없다. 전산세무회계 검정시험을 준비하는 것은 회계와 세무에 관한 이론을 숙지하고 그 이론을 바탕으로 전산실무를 익혀야 된다. 따라서 본서는 이론은 기본이론정리와 평가문제를 통하여 충분한 학습을 할 수 있게 하고, 실무는 다음과 같은 단계의 학습으로 반복 정리하여 실무시험의 적응력을 최대한 높이려 하였다.